taxing unrealized gains explained

Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Unrealized gains and losses are subject to market fluctuations.

Unrealized Capital Gains Tax Explained

His American Families Plan would tax unrealized capital gains at death for unrealized capital gains worth over 1 million 2 million for married couples.

. The tax on unrealized gains being considered by Democrats would undoubtedly have similar negative Impacts on workers and the economy. The third problem is the exemption for unrealized gains on assets that taxpayers leave to their. Many of the highest earners in the US including Elon Musk Jeff Bezos Larry Ellison and others have.

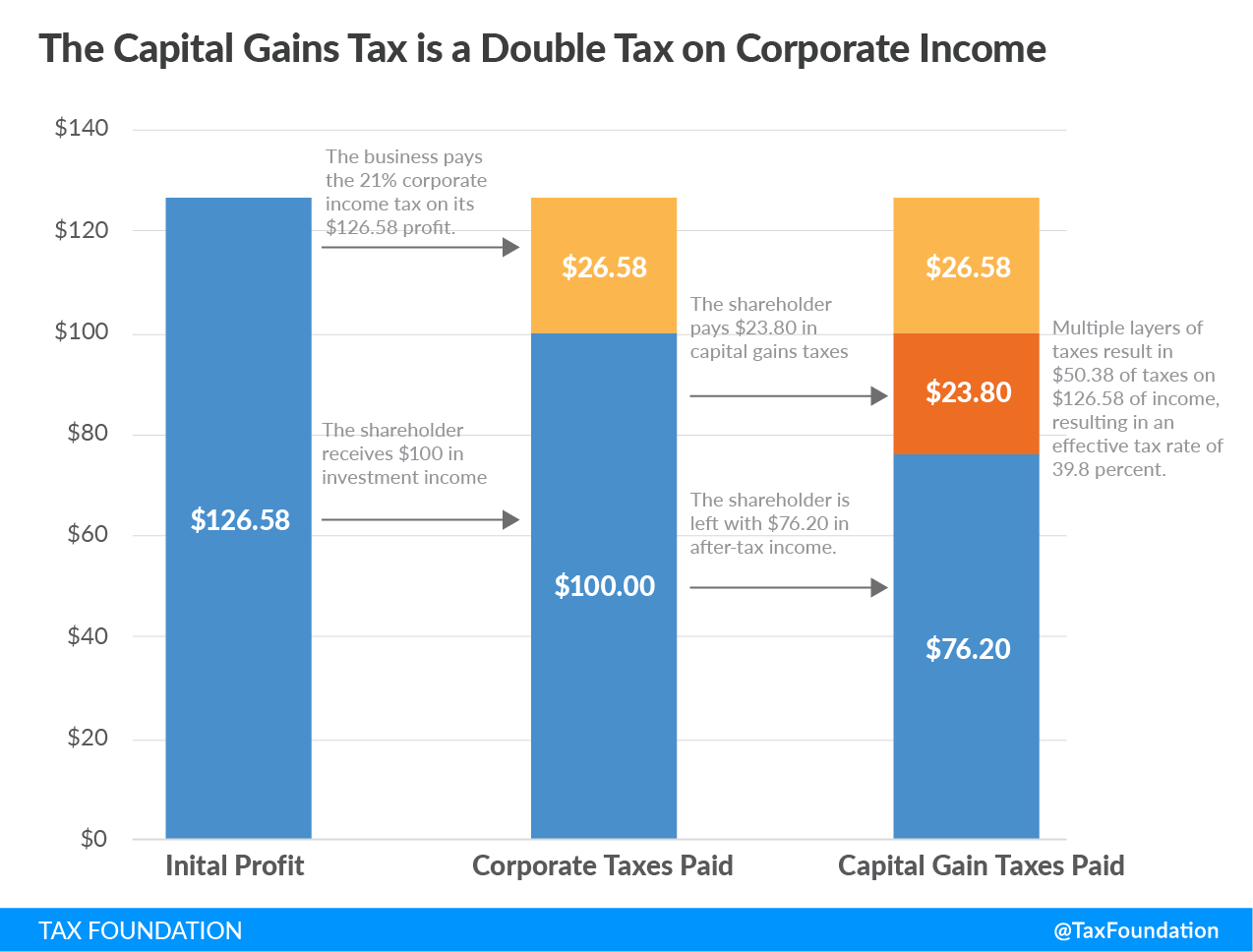

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. The Tax Code is Already. Until the asset is sold.

Bidens Proposal to Tax Unrealized Gains Upon Death of Asset Owner. The Unintended Consequences Of Taxing Unrealized Capital Gains. The Problems With an Unrealized Capital Gains Tax.

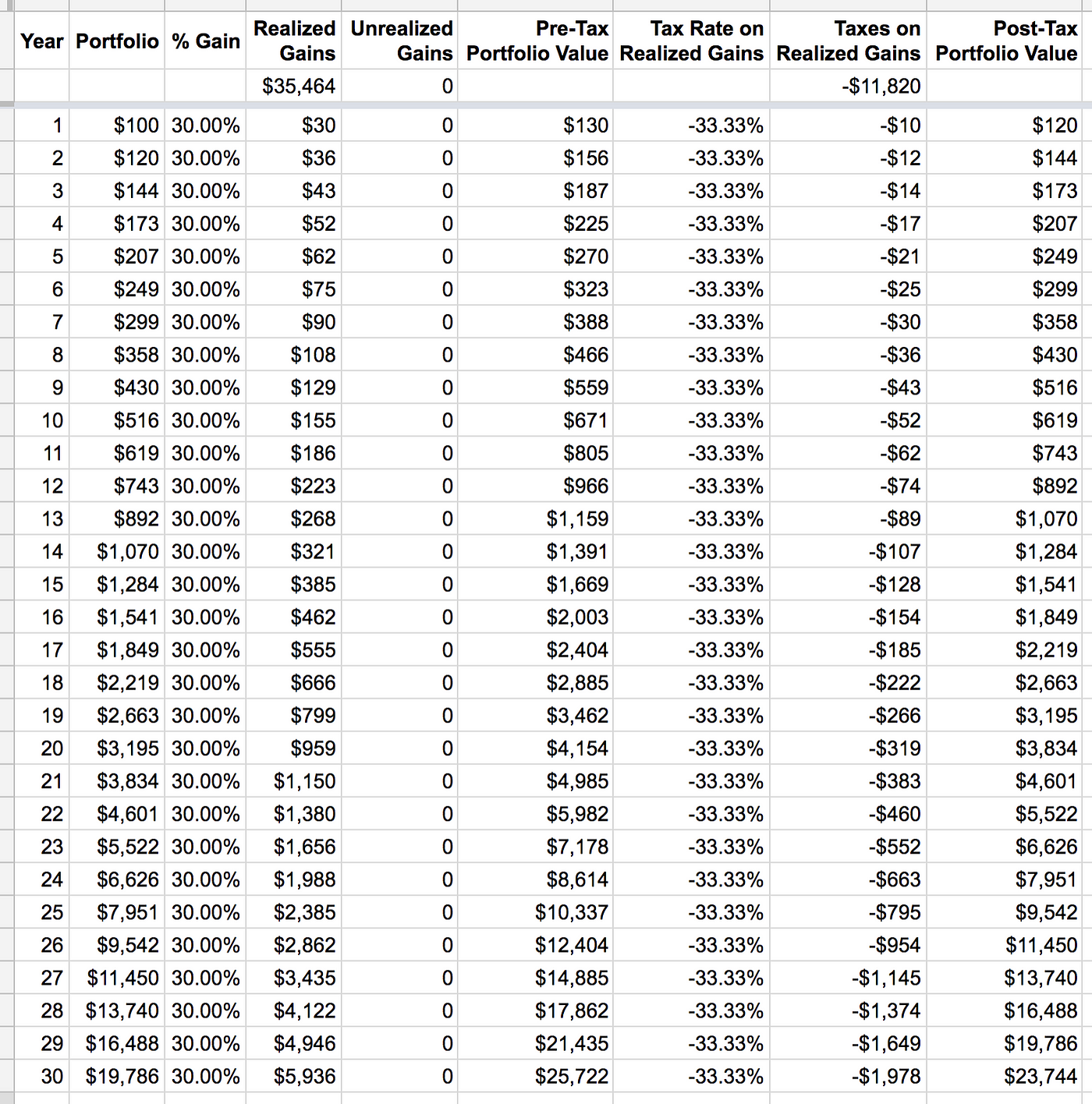

The Institute on Taxation and Economic Policy explained that current tax policy allows the wealthy to defer taxes for years while growing their wealth faster than middle-class. The first 1 million of. For example if you buy a.

You buy 05 Bitcoin for 30000. It is the increase or decrease in the value of the asset that is kept. The plan includes many exceptions and special rules.

These unrealized gains would be taxed as if they had been sold at death or when transferred. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by Democrats as another step. An unrealized gain or loss is a capability of a business to have profit or loss on paper which results from an investment.

Unrealized gains are on paper profits meaning they are not actual in-the-pocket profits. Is a Wealth Tax on Unrealized Capital Gains the Final Straw. You have an unrealized gain of 3000.

Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained. The price of BTC has increased by 3000 but you havent sold your asset. President Bidens proposal to require roughly 700 US.

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

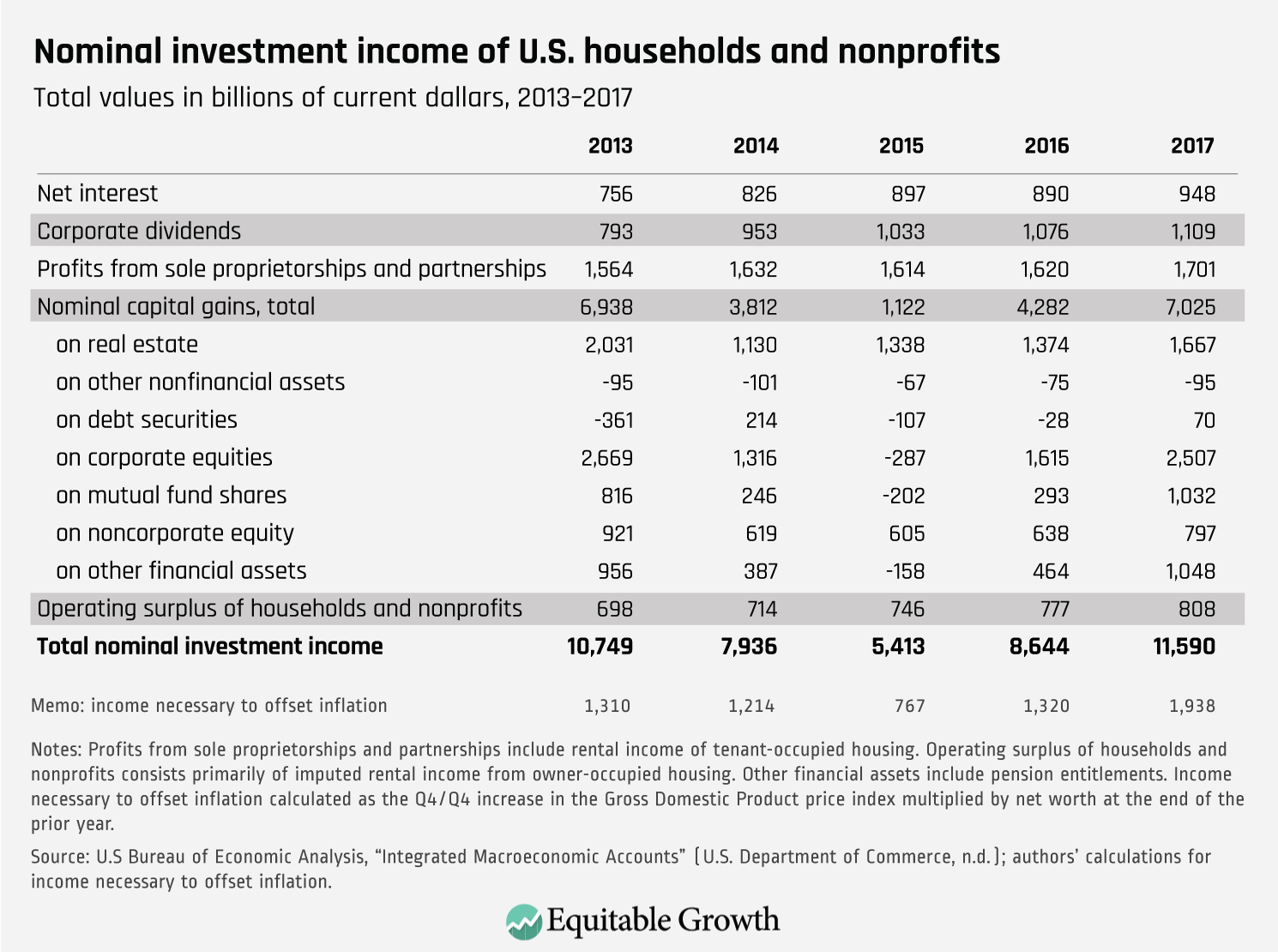

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

What Are Unrealized Gains And Losses

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

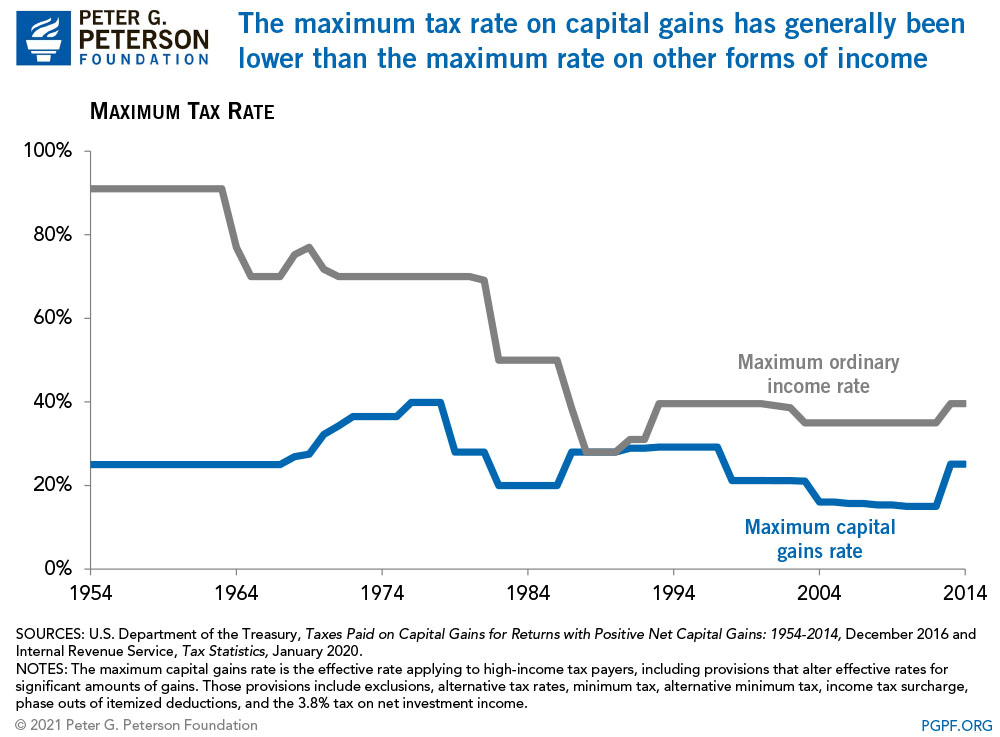

An Overview Of Capital Gains Taxes Tax Foundation

Unrealized Capital Gains Tax Explained

Unrealized Gains Losses Explained Sofi

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas

The Unintended Consequences Of Taxing Unrealized Capital Gains

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

An Overview Of Capital Gains Taxes Tax Foundation

2021 Capital Gains Tax Rates In Europe Tax Foundation

Crypto Tax Unrealized Gains Explained Koinly

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth