s corp tax rate calculator

Easily calculate your tax rate to make smart financial decisions Get started. S Corps S Corp guides resources and calculators for saving taxes.

State Corporate Income Tax Rates And Brackets Tax Foundation

Only in its effect on the buyer does the gross receipts tax resemble a sales tax.

. Provision for Automatic calculation of deduction us 80 GG towards Rent Payment when HRA is not received. Singapores Personal Income Tax rate ranges from 0 to 22. The highest personal income tax rate of 22 are for individuals with an annual taxable income of more than 320000.

View the current Gross Receipts Tax Rate Schedule. Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No. Self Employment Business tax strategies that help you explore new ideas.

Find my W-2 online. 2022-2023 select better option from Old regime vs new regime of taxation us 115BAC for Individual HUF Individual and HUF has to choose any one option out of two options for paying income tax for FY. Self Employment Find out how much youll owe in.

The S corp income passes through to the owners individual tax return as salary and distributions. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Income Tax Calculator in excel for FY.

Well even account for any estimated tax. The federal corporate income tax by contrast has a marginal bracketed corporate income taxNew Jerseys maximum marginal corporate income tax rate is the 6th highest in the United States ranking directly below Alaskas 9400. The overall audit rate is low.

More details about Singapore Resident Tax Rates can be found here. Technology provided by PropertyInfo. This highly-reputable online tax calculator in the Philippines frees you from the many stresses that arise from the newly-implemented tax laws and case-specific formalities.

The owners salary pays employment taxes and income tax while. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. Age is calculated as per IT Act automatically based on DOB.

Skip To The Main Content. It is the 1 online tax calculator in the Philippines. The License Fee cannot be less than 25.

If an amendment changing your stock or par value was filed with the Division of Corporations during the year issued shares and total gross assets within 30 days of the amendment must be given for each portion of the year during which each distinct. What is the S corp tax rate. LLC Taxes Helpful and comprehensive tax guides for LLC owners.

The minimum tax for the Assumed Par Value Capital Method of calculation is 40000. At that point the S corp income is subject to federal state and FICA taxes based on the individual owners tax bracket and filing status. 2021-2022 Tax Brackets Tax Calculator.

Check SBI FD rate of interest and calculate FD final amount via SBI FD Calculator on The Economic Times. It is an ideal choice for small-scale business owners self-employed individuals and freelance workers. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll.

The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business. Calculate Taxable Income Tax etc for Old Regime. Its in your best interest to file right away to minimize other problems like.

Mortgage rates valid as of 24 Aug 2022 0912 am. Senior Citizen Very Senior Citizen Physically. The S corp doesnt have a specific tax rate because S corp income passes through to the owners individual tax return.

Tax Provisions are considered where ever required wrt. S-corp income tax return deadline. And then apply the correct tax rate to come up with an estimate of what you should be paying for taxes.

Taxfyles small business tax calculator accurately estimates your business tax refundliability at the end of the year. SBI FD calculator online - Calculate SBI fixed deposit Interest rate using SBI Fixed Deposit calculator 2022. New Jersey has a flat corporate income tax rate of 9000 of gross income.

If the number you enter here is lower your standard deduction will be used to determine your average tax rate. The License Fee is payable by the original due date for filing the Income Tax return or request for extension and applies to the tax year following the Income Tax year. For more information see our S Corp Taxes guide.

An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local income taxes. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Actual results will vary based on your tax situation.

LLC S-Corp C-Corp - you name it well calculate it Services. LLC Taxes Discover your LLCs total taxes effective rate and potential savings. STGC does not make any express or implied warranties with regard to the use of the Stewart Rate Calculator and shall not be responsible for any errors or omissions or for the results obtained from the use of such information.

The Income Tax and License Fee are reported on Form SC1120. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. An S-corp or S-corporation is a tax status allowing business owners a flexible way to start small and grow.

S Corp Vs Llc Difference Between Llc And S Corp Truic

The Basics Of S Corporation Stock Basis

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

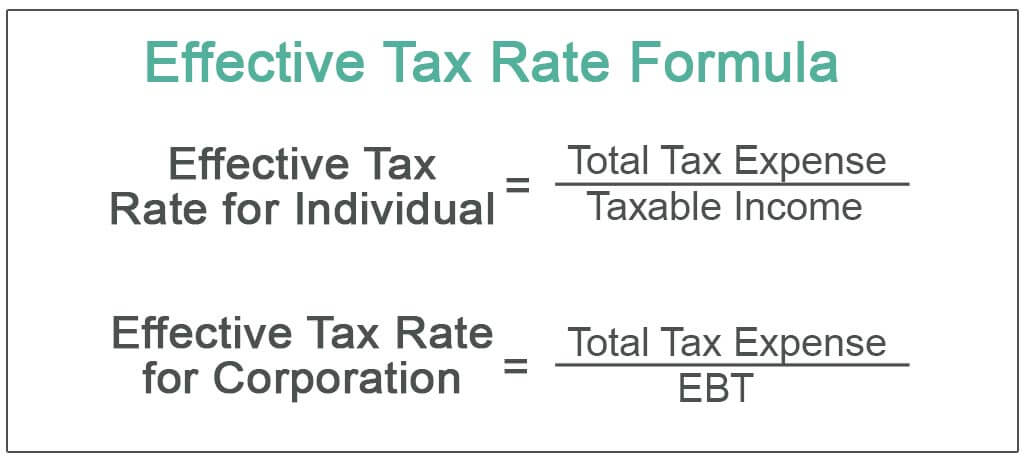

Effective Tax Rate Definition Formula How To Calculate

How Much Does A Small Business Pay In Taxes

Corporate Tax Meaning Calculation Examples Planning

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Instant Tax Savings For The Self Employed Business Tax Small Business Accounting Business Bank Account

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Corporate Tax Meaning Calculation Examples Planning

Taxtips Ca Business 2020 Corporate Income Tax Rates

Getting To Know Gilti A Guide For American Expat Entrepreneurs

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

S Corp Payroll Taxes Requirements How To Calculate More

Determining The Taxability Of S Corporation Distributions Part Ii

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Determining The Taxability Of S Corporation Distributions Part I